Kaleb wants to get a payday loan. Payday loans are short-term, high-interest loans that can be tempting for those in need of quick cash. However, it’s crucial to understand the potential risks and benefits before making a decision.

This article will provide an overview of payday loans, including their purpose, prevalence, and potential risks and benefits. We will also discuss Kaleb’s financial situation, explore alternative options, and guide him through the decision-making process.

Introduction

Payday loans are small, short-term loans that are typically due on the borrower’s next payday. They are often marketed to people who need quick cash to cover unexpected expenses, such as a car repair or medical bill.

Payday loans are a popular source of credit for people with bad credit or no credit history. However, they can be very expensive, with interest rates that can reach 400% or more. This can make it difficult for borrowers to repay their loans on time, leading to a cycle of debt.

Prevalence of Payday Loans

Payday loans are a common source of credit in the United States. In 2019, an estimated 12 million Americans took out a payday loan, borrowing a total of $9 billion.

Payday loans are particularly popular among low-income households. A 2016 study by the Pew Charitable Trusts found that 58% of payday loan borrowers had annual incomes of less than $30,000.

Risks and Benefits of Payday Loans, Kaleb wants to get a payday loan

There are a number of potential risks and benefits associated with payday loans.

Risks

- High interest rates

- Short repayment terms

- Late fees

- Collection costs

- Damage to credit score

Benefits

- Quick access to cash

- No credit check required

- Can be used for any purpose

Kaleb’s Financial Situation

Kaleb is a 25-year-old single father with two young children. He works full-time as a cashier at a local grocery store, but his income is barely enough to cover his monthly expenses. He is currently considering taking out a payday loan to help make ends meet.

There are several reasons why Kaleb is considering a payday loan. First, he is facing an unexpected expense: his car needs major repairs, and he does not have the money to pay for them. Second, Kaleb’s hours at work have been cut back recently, which has reduced his income.

Third, Kaleb has poor credit, which makes it difficult for him to qualify for a traditional loan.

Other Financial Options

Before taking out a payday loan, Kaleb should explore other financial options. One option is to contact his creditors and explain his situation. They may be willing to work with him to create a payment plan that he can afford.

Another option is to seek out government assistance programs. There are several programs available to low-income families, including food stamps, Medicaid, and housing assistance.

Payday Loan Options

Payday loans are short-term, high-interest loans that are typically due on the borrower’s next payday. They are often used by people who need quick cash to cover unexpected expenses.

There are a number of different payday loan lenders, each with their own interest rates and fees. It is important to compare the different options before choosing a lender.

List of Payday Loan Lenders

- CashNetUSA

- Check ‘n Go

- Money Mart

- Advance America

- Ace Cash Express

Comparison of Interest Rates and Fees

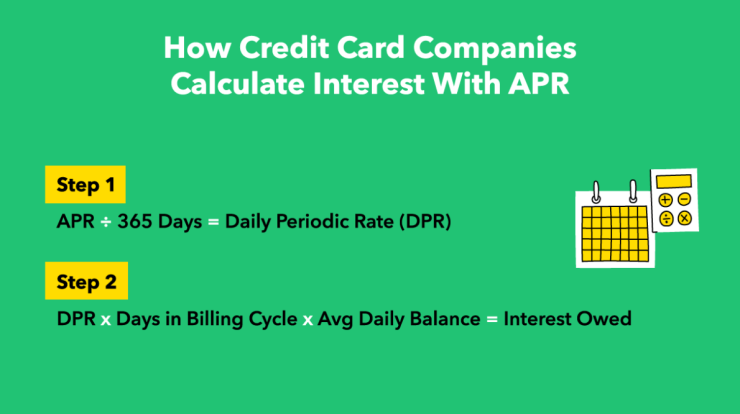

The interest rates on payday loans can vary significantly from lender to lender. Some lenders charge an annual percentage rate (APR) of over 400%, while others charge rates as low as 30%. The fees for payday loans can also vary, and may include origination fees, late payment fees, and NSF fees.

Process of Applying for a Payday Loan

The process of applying for a payday loan is typically simple and quick. Most lenders require borrowers to provide their name, address, phone number, and Social Security number. Borrowers may also be required to provide proof of income and employment.

Once a borrower has been approved for a payday loan, they will receive the funds in cash, by check, or by direct deposit. The loan must be repaid on the borrower’s next payday.

Alternatives to Payday Loans: Kaleb Wants To Get A Payday Loan

Payday loans can be a quick and easy way to get cash when you need it, but they can also be very expensive. There are a number of alternatives to payday loans that can help you get the money you need without having to pay high interest rates and fees.

Non-Profit Organizations

There are a number of non-profit organizations that offer financial assistance to people in need. These organizations can provide you with loans, grants, and other forms of financial assistance. Some of the most well-known non-profit organizations that offer financial assistance include:

- The Salvation Army

- United Way

- Catholic Charities

- Jewish Family Services

- Lutheran Social Services

Government Programs

There are also a number of government programs that can help people with financial emergencies. These programs can provide you with loans, grants, and other forms of financial assistance. Some of the most well-known government programs that offer financial assistance include:

- Supplemental Nutrition Assistance Program (SNAP)

- Temporary Assistance for Needy Families (TANF)

- Supplemental Security Income (SSI)

- Social Security Disability Insurance (SSDI)

- Unemployment Insurance

Budgeting and Saving Money

One of the best ways to avoid payday loans is to budget your money and save for unexpected expenses. Budgeting can help you track your income and expenses so that you can make sure that you are not spending more money than you earn.

Saving money can help you build up a financial cushion so that you can cover unexpected expenses without having to borrow money.

There are a number of resources available to help you budget and save money. You can find budgeting worksheets and other resources online, or you can talk to a financial advisor.

Decision-Making Process

Kaleb must carefully weigh the pros and cons of obtaining a payday loan before making a decision. He should assess his financial situation, explore alternative options, and consider the potential consequences of taking on additional debt.

To make an informed decision, Kaleb should consider the following factors:

Pros of Payday Loans

- Quick and easy access to cash.

- No credit check required.

- Can help cover unexpected expenses.

Cons of Payday Loans

- Very high interest rates and fees.

- Can lead to a cycle of debt.

- May damage credit score if not repaid on time.

Kaleb should also consider seeking support from a financial counselor or credit counseling agency. These professionals can provide guidance and help him develop a plan to manage his finances and avoid predatory lending practices.

Alternatives to Payday Loans

If possible, Kaleb should explore alternative options to payday loans, such as:

- Negotiating a payment plan with creditors.

- Borrowing from family or friends.

- Seeking government assistance programs.

- Using a credit card with a lower interest rate.

FAQ Compilation

What is the purpose of a payday loan?

A payday loan is a short-term loan, typically due on the borrower’s next payday. It is designed to provide quick cash for unexpected expenses or emergencies.

What are the risks of payday loans?

Payday loans come with high interest rates and fees, which can lead to a cycle of debt. They can also damage credit scores if not repaid on time.

What are the benefits of payday loans?

Payday loans can provide quick access to cash when other options are not available. They can also be helpful for people with bad credit who may not qualify for traditional loans.

What are some alternatives to payday loans?

There are several alternatives to payday loans, including non-profit organizations that offer financial assistance, government programs, and budgeting and saving tips.